When you start out on social media, it’s important to make marginal gains. By this, I mean to start small and work your way up. You don’t want to have 3 mediocre social media channels if you could use the same amount of energy to have 1 great social media channel that is providing value and feeding you leads. Social Media Marketing for financial advisors at the end of the day, is about getting a return for the value you are providing.

A good way to figure out what you should be posting is by doing some scouting. By scouting, I mean checking out what your competitors are doing online. What channels are they on? What type of content do they post? How often do they post? These are a few of the questions you should be asking yourself as your research your online environment. From here, you can answer these questions for your own practice based on how they are going for others. Once you have an idea of what you’d like to post and how you’d like to appear it’s time to set up your profile.

When setting up your social media profiles, you should aim to fill out everything possible and use a professional image. A professional image is a picture that wasn’t taken as a selfie or in a mirror. You should use a tripod and make sure you have good framing/lighting or you should pay a professional.

Now that your social media profile is set up it’s time to attract people from your target audience using information and content that reflects positively on your business. The post types that we’ve seen work well are interesting, education, service-oriented, and containing financial news. Content types like these offer value to the end-user. You want all of your posts on social media to provide some form of value to your audience as these people are whose attention you want.

To ensure that you are always providing high-quality content, you need to create a content marketing plan. A content marketing plan tells you what’s being posted when it’s being posted, why it’s being posted, and how your audience can interact with your piece of content.

Why put in all this work just to know what is being posted and when?

-Because coming up with posts on the spot leads to posts without value

-You’ll make fewer mistakes

-You’ll post more consistently and frequently

-You can’t focus on the big picture if you’re stuck on what to post

-You won’t miss relevant holiday and yearly opportunity dates to post something engaging, funny, or on-topic

-It will make it easier to track what is working and what isn’t

Now that we have a content marketing plan, we’ve set up our profile, and we have a professional image; what’s next?

Create a content library for where your images, videos, and media will live. If you’re starting really small, this could be as simple as some Google Drive folders. From here you now have a place to access the content, you have a schedule for posting it, and you know the type of content to create for your audience. Depending on your team you’ll need to fill in the gaps on who will be putting the content together and what form it will take (video, pdf, image, etc.)

If you don’t have a creative team of any kind, you may need to get some help. Be sure that whoever you have is attentive to detail, has a track record of creating really professional pieces, and understands your content calendar. For some of these projects, it will save you time and money to work off of pre-approved templates with your creativity. This way your brand appears consistent throughout your content matches your brand guidelines and can be put together efficiently regardless of the differences between last week’s topics and this week’s topics.

From here most of your work will fall into 3 categories: social media management, account growth, and social media auditing:

For social media management, there should be someone on your team dedicated to responding to direct messages on that account, making the posts, and responding to people in the comments.

For growth, you want to figure out how you can get more people to follow what you’re doing. Putting out a post to 25,000 followers will have a much bigger impact on your business than putting out a message to 25. What are your strategies to get more followers? What incentives are easy to provide for a simple follow?

One organic idea is Facebook allows page owners to invite people who have interacted with their posts to follow their page. I’d suggest doing that for every person who interacts with a post you make. It won’t be an overnight success but it will provide steady growth of people receiving your information.

If you’re looking for a paid way to speed up this process, you can promote your posts and put some of your budgets to blast those posts out to more people or do a campaign that invites people to like your page. Spending your money to boost a post or do a follow campaign employs 2 different strategies so you can get creative with your objectives.

Depending on what platform you use, I’d suggest digging deeper into strategies people use to gain a larger following.

For Social media auditing, you’ll want to have data from time periods where you’ve been posting consistently, interacting on your page, and generally providing value. This way when you look at your numbers, they’re telling an accurate story. If you have 3 posts in 3 months, there probably aren’t enough followers and interactions to truly dive deep into what is happening because, well, nothing is happening.

If you do have data from this time period, you know what metrics matter, and you have your analytics setup correctly you can do a lot of high-level activities including:

How much does it cost to acquire a lead through our social media strategy?

How many leads did we generate using social media?

What is your customer acquisition cost? This will depend on your mix of paid/organic.

If we don’t have our content calendar, our strategy, and our production schedule laid out – how can we ever get to the point of seeing social media’s ROI? You can’t.

This is why we suggest starting small and taking the talents of you and your team to start and as you see the return for what you’re putting in scaling up.

Final 3 tips for social media marketing for financial advisors :

1. Learn the landscape: Prospects, Clients, and Competitors

Check out what your competitors post, what carriers post, and what kind of posts you like to interact with. See what pages with a lot of followers are doing or offering. See how they set up their pages, their posts, and what they’re doing to get people to their website. There are probably a few pieces of their strategy that you can use regardless of how many followers you have. Also learn the differences between the platforms and what audiences hang out there.

Facebook: Community-based content with a large quantity of age 50+

Instagram: personal image and story-based content, age 30-50

LinkedIn: Business advice and info, Networking professionals, sales managers and entrepreneurs

Twitter: Recent events and trends, reporters and journalists

Which one fits our target audience?

Which one fits our content?

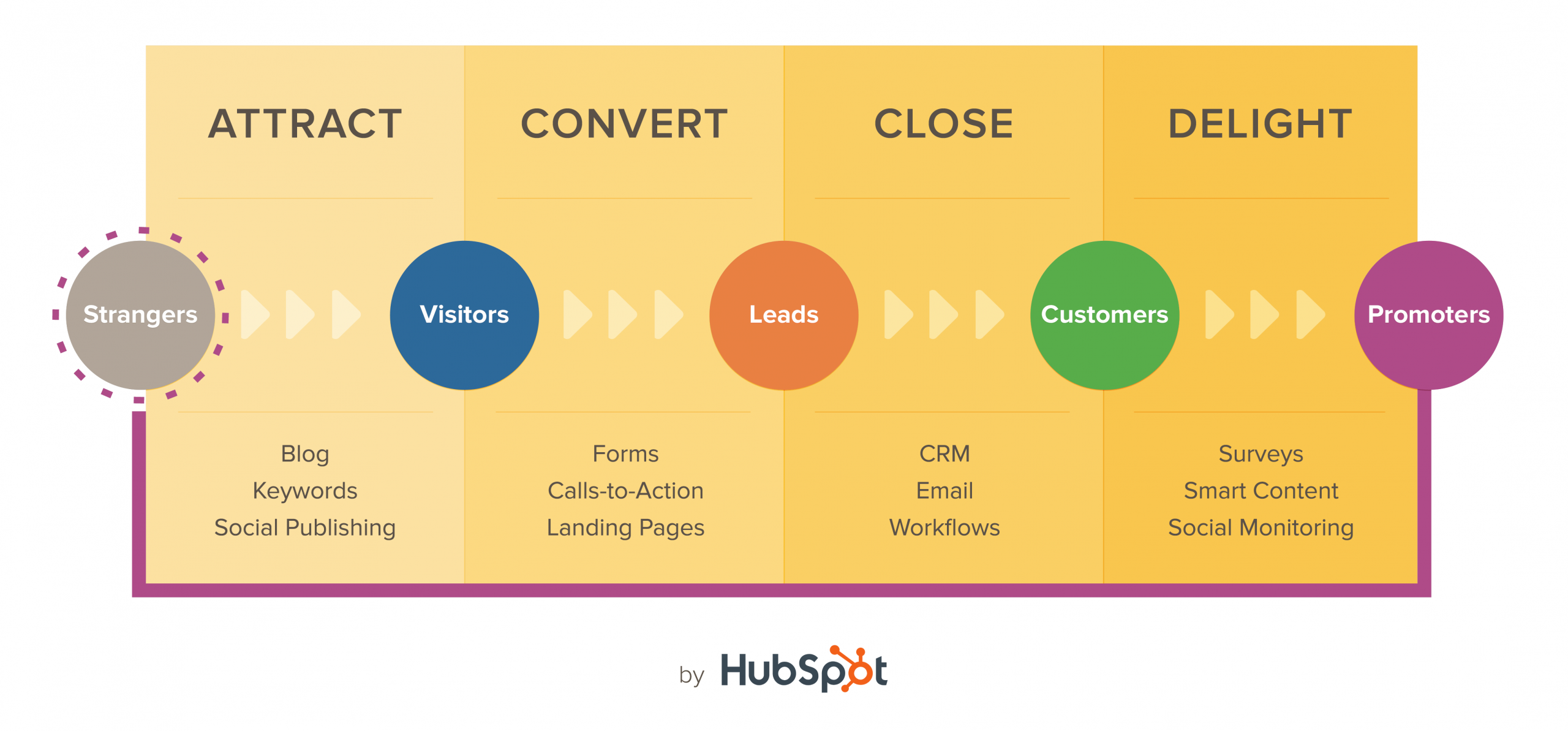

2. Social media is used for marketing content distribution – not sales, we’re at the top of the funnel

80 percent of your social media activity should be geared toward providing something to your audience. The other 20 percent can be devoted to promoting yourself or your business. Users go on social to escape, relax and socialize. Don’t expect a newsfeed ad to instantly motivate a person to invest their life’s savings. If you don’t listen to this, your success rate for gaining an audience and their engagement will be low. Your goal is not to get likes, it’s to grow your business. Social media is a great tool for the modern marketer but its highest goal is to educate your audience and get them to a point of sale. Doing this in a way that is desirable to your online audience is the difference between a dead-end and a windfall.

3. Determine your marketing objectives then crush them!

Social media can feel like a huge waste of time when you don’t know why you’re doing it. Doing it because everyone else is doing it isn’t a good reason. You should be doing it because it contributes to bringing in more potential leads and clients. If you’re just starting out you’ll need to determine what you’re looking for. Here are a few examples of good objectives to set for your business:

-Building an organic list of email subscribers

-Driving traffic to your website

-Engagement on the platform to grow your account’s reach

-Prospect calls or meetings booked once you have a large enough base to market to

I’d suggest looking into compliance-friendly social media for financial advisors – that’s not what today’s presentation was about but it’s important for your practice. You’re 1 google search away from having all the info on that topic that you need and the SEC guidelines are on their website.